You can change them in the customer center or the ite.

#SALES TAX IN FOOTER QUICKBOOKS FOR MAC HOW TO#

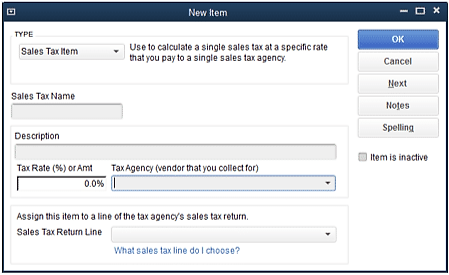

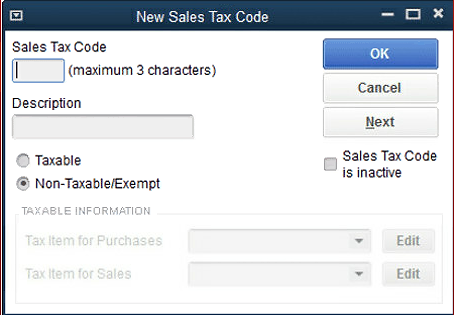

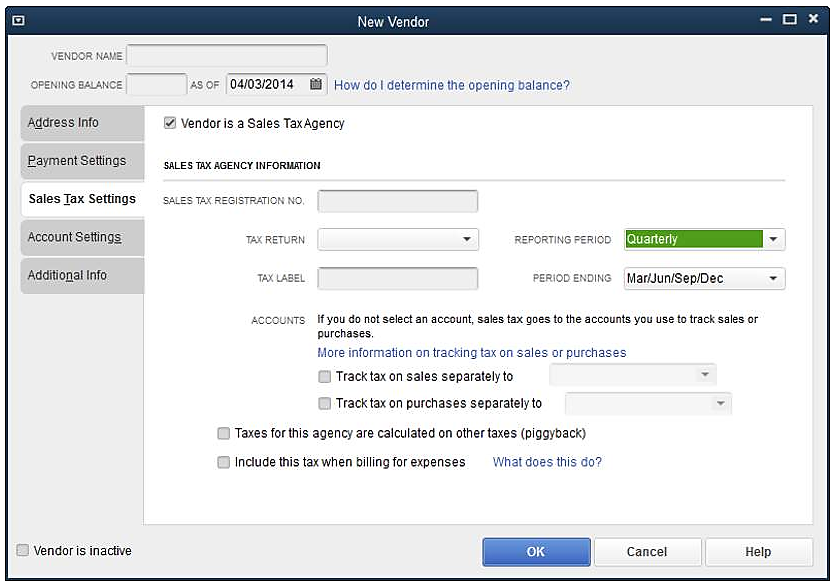

On the Preferences window, select Sales Tax then go to the Company Preferences tab In this learn QuickBooks training tutorial, you will learn how to change the defaults of the sales tax. Go to the Edit menu, then select Preferences. To start recording sales tax in QuickBooks Desktop, you need to turn on this feature and set up sales tax items or tax groups. Note: Before you set up your sales tax items/groups, make sure you check the tax rates and requirements with your tax agency.

like a refund, you did not expect or a mista.

In the Edit Sales Tax Component window, change the rate. In the Sales Tax Rates and Agencies table, choose the rate you want to change and select Edit. Under Related Tasks, select Add/edit tax rates and agencies. For future reference, you can also check out this article and click the Sales tax item drop-down on step 4 for more information: Set up sales tax in QuickBooks Desktop To edit sales tax rates: Go to Taxes from the menu, then choose Sales Tax. Enter the new rate on the Tax Rate (%) section, then hit OK. Select the Reason for the adjustment Locate your Sales Tax item, then right-click and select Edit item. Find the tax period you need to adjust, and then select View return. Do not enter any Sales Items - just enter the Sales Tax Items Select Taxesfrom the Navigation bar, and then go to sales taxtab.

To credit Sales Tax Payable, enter a Sales Receipt as described in the section titled, Adjusting Income Accounts of our article, Entering Adjusting Entries That Impact Items In QuickBooks- Part 1, and enter the Sales Tax Item (s) you need to adjust. Home How to adjust sales tax items in QuickBooks

0 kommentar(er)

0 kommentar(er)